About loan

|

№ |

Indicators |

Key Terms |

|

|

1 |

Loan Purpose |

Renovation of a single-family dwelling and apartment in a multi-apartment building |

|

|

2 |

Loan Term and Grace Period |

Up to 10 years (grace period on principal – up to 6 months) |

|

|

3 |

Loan Amount |

Renovation, reconstruction of a single-family dwelling |

Not more than UZS 300.0 (three hundred) million |

|

Renovation of an apartment in a multi-apartment building |

Not more than UZS 200.0 (two hundred) million |

||

|

4 |

Down Payment |

Not required |

|

|

5 |

Interest Rate |

27% per annum |

|

|

6 |

Loan Disbursement |

Transfer of funds under a purchase agreement or to the borrower's bank card. Loan funds are disbursed in a minimum of two stages. In the first stage, up to eighty percent (80%) of the total loan amount is released. The remaining balance is disbursed in the second stage, following verification of the proper use of initial funds and submission of a completed monitoring report. |

|

|

7 |

Loan Repayment |

Annuity or differentiated payment |

|

|

8 |

Loan Security |

Residential property undergoing renovation or reconstruction from the loan funds is accepted as collateral. |

|

|

9 |

Who is Eligible for Loan? |

The owner of the residential property being renovated or reconstructed from the loan funds, or their immediate family members (including parents, siblings, spouse, children, daughter-in-law, or son-in-law) who are permanently registered at the property. When considering granting a loan to a close relative of the residential property owner, verification is required to confirm that the borrower is permanently registered at the property’s address and is indeed an immediate family member of the owner. |

|

|

10 |

Additional Conditions |

The loan amount shall not exceed 80 (eighty) percent of the collateral value. At the borrower’s discretion, funds credited to their bank card may be withdrawn in cash at the bank’s counter to conveniently cover expenses related to housing renovation. |

|

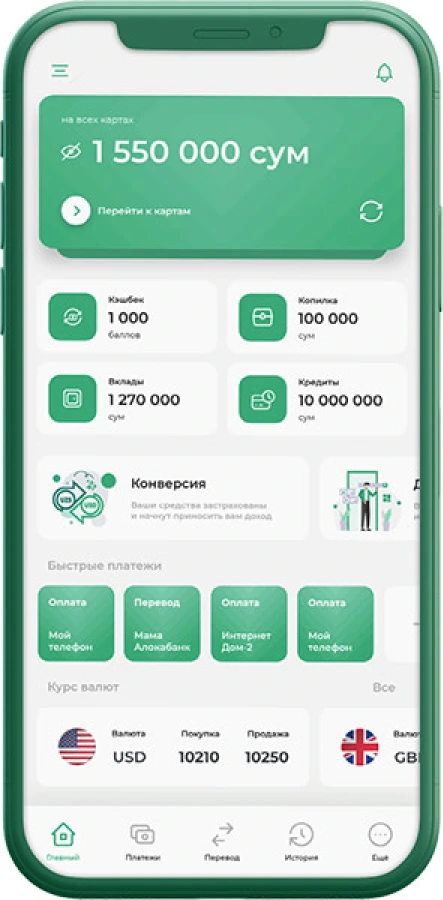

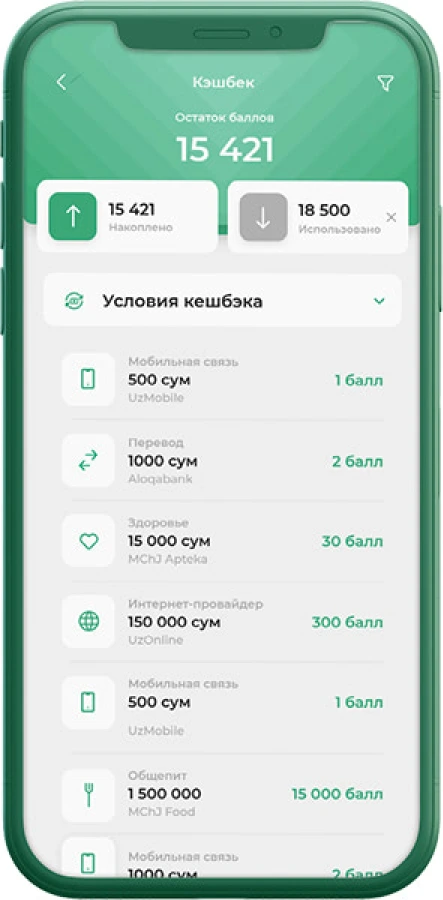

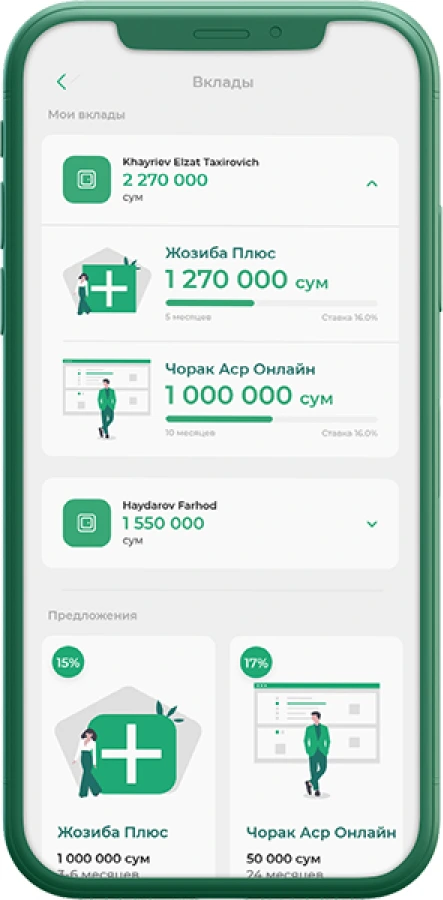

You can get online microloan via the Zoomrad mobile application!